Navigating the Crypto Market: Understanding the Misunderstood

Addressing Common Misconceptions and Challenges for Investors and Founders

During bear market cycles, market participants are faced with the reality that things eventually return to the mean. While there are many valuable lessons to be learned from the recent downturn, some are more difficult to grasp than others. As advisors to both investors and entrepreneurs in the industry, we have the advantage of gaining insight from firsthand experiences and observations, which helps us understand market sentiment and the issues that are most salient.

The current understanding of digital assets is limited and people are struggling to differentiate them from traditional forms of investments. This is partly due to the fact that we are still in the early stages of technological advancement and people are trying to adapt old ways of thinking to the digital age, which may not be suitable.

It is interesting to note that the same human biases that have led to mistakes in the past, continue to affect investors and entrepreneurs today. Fear & greed are the primary motivators for many market participants, regardless of whether they are buying digital assets or traditional shares.

During bullish markets, investors tend to become more confident and less stringent in their due diligence, which can lead to impulsive decisions. This mentality can also extend to entrepreneurs who secure funding more easily and may become overly confident in their abilities to easily raise financing.

An example that illustrates this well is a conversation with a founder in the cryptocurrency space who we were providing advice to. We discussed other management teams we were in contact with and how we believed they were attempting to sell their businesses at inflated prices without even having the basic documentation to attract a serious buyer. This is what he responded to us:

“Sure, I mean if you were able to raise $10m on just a pitch deck in two weeks in 2021, you’d probably think that’s normal… and when you hear someone telling you that your company isn’t worth even 10% of what it was at the top you’d get annoyed at that…”

The vicious cycle between investors and founders feeds into each other, and when leverage and derivatives are added, it becomes an extremely volatile situation. Ultimately, this leads to negative consequences for those who follow the trend, resulting in pain and losses for all parties involved.

As we see the fallout of various projects, funds, and individual investors that have suffered losses during the market downturn in 2022, it's important to examine the misunderstandings and misconceptions that led to these losses. In addition to common human emotions and biases, there are specific issues that can be identified. Crypto assets, for example, possess characteristics of public equity markets, commodities, and currencies, and often resemble early-stage start-ups with rapid paths to market. It can be challenging to categorize them within traditional financial frameworks. It's important to understand the unique characteristics and risks associated with digital assets to make informed investment decisions.

What are the underappreciated differences between crypto and other early-stage industries??

Marked to market: tokens are traded 24/7 every day of the year, making them more similar to public equity than to a private stake in a company. The price of a token is influenced by a larger number of variables when compared to a startup equity. Managing a traded asset requires a deeper understanding of concepts like hedging and floats, which are often unfamiliar to early-stage founders and investors. Failing to take this into consideration can have severe consequences for projects and their backers.

Valuations: Many market participants are still struggling to understand how to value cryptocurrencies as traditional valuation frameworks are not exactly applicable to tokens. Some argue that demand and supply are the only drivers of token prices, however this is a simplistic view of a complex system that is influenced by a variety of factors different from traditional corporate finance. With the new technological paradigm, financial analysis and corporate finance will have to evolve to keep up. The key to success in this market is developing a framework that can evaluate a combination of on-chain and off-chain metrics.

Liquidity: Liquidity is a crucial aspect in the cryptocurrency market. If a token is not listed on a centralized exchange with a significant number of buyers and sellers, the price can be highly volatile due to large gaps in the order books. Even if the token has strong fundamentals, lack of liquidity can be a significant issue. Often, founders are not adequately prepared to manage this aspect of their business, as they do not hire or consult with individuals who have the necessary skills to address this problem. The same can be said for venture capital investors, who may not have experience dealing with trading securities at the early stages of capital allocation.

Treasury Management: This can pose a significant challenge, especially for entrepreneurs. For example, if a startup is based in Europe and receives payments in euros and matches them with expenses also in euros, it's relatively easy to manage. However, if the company operates internationally, it must be cautious to manage other fiat currencies. This can be detrimental, as we have seen in the past, such as during the Asian financial crisis, where companies took out loans in US dollars and were unable to repay when their currency depreciated rapidly against the dollar. In the crypto market, this issue is magnified as payments are often made in a highly volatile token, which is similar to being paid in equity. Additionally, some expenses may need to be paid in fiat currency, requiring the sale of tokens in the market which can further depress the token price, especially during a bear market and when liquidity is low. This is a common problem that founders often overlook and can have severe consequences.

Custody / Key Management: Another issue that will likely become more prominent in the future is the question of who holds and manages the private keys for the treasury. Self-custody and decentralized technology can create the perception of security and reliability, but having a small group of founders responsible for holding and managing millions or billions of dollars of other people's money is not the most secure solution. There are many vulnerabilities such as the founders being threatened, blackmailed, or even faking their own death to commit fraud and steal the funds. A custody solution that involves a trusted third-party custodian, but where the deposited coins are transparently verifiable on the blockchain, cannot be lent out, and are segregated from other accounts, could be a viable alternative. This is similar to the concept of a bank, and Custodia Bank is a good example of this.

What are the steps a founder can take to address these problems?

To address the problems mentioned, a founder should take the following steps:

Hire an expert. Hire or consult with someone who has experience in the public markets to gain insight on flows, liquidity, and managing token price during bear markets.

Measure value. Developing a framework, either internally or with the help of an expert, to monitor both market and business metrics is crucial for understanding what drives value and what undermines it. This will be highly beneficial when tracking your business performance and when seeking financing.

Improve your treasury. Review and improve treasury management policies by dedicating a person or team to this task, and ensure they have the necessary market experience. Be mindful of matching inflow and outflow in different currencies effectively.

Stabilize your price. Learn about derivatives and how to leverage them to hedge the treasury and control token prices.

Security, security, security. Consider the safety and security of the tokens by implementing a solid and tested security process. Develop a plan for what will happen if a co-founder is incapacitated and ensure there is a mechanism in place to protect token holders' funds.

What are the steps an investor can take to address these problems?

To address the problems mentioned, an investor should take the following steps:

Hire an expert. Hire or consult with someone who has experience in the public markets to gain insight on flows, liquidity and the projects you are tracking or have invested in.

Develop a framework. Having a framework in place that can track both market and business metrics will provide you with a deeper insight into the factors that drive value, and help you identify potential red flags. Hire an expert or seek advice from someone who has experience in developing models for the crypto market.

Check their treasury. Inquire about the founders' treasury management, including their process of succession, management of inflow and outflows, and internal expertise.

Verify their expertise. Compare the token's price drop with similar projects, and take note of those that have taken steps to contain their price drop such as hedging or reducing token supply.

Demand safety. Ask portfolio companies to increase their security standards, including the use of a custodian, cyber attack prevention and measures to ensure the founders won’t run away with the money.

These are some of the main issues present in the crypto market. Leverage, while important, has been discussed extensively in the industry and it is expected that people will have learned from the mistakes of the past. However, it's worth noting that human memory can be short-lived and investors may take on debt once again when the market returns to all-time highs. It's important for investors and founders to stay aware of these risks and address them proactively.

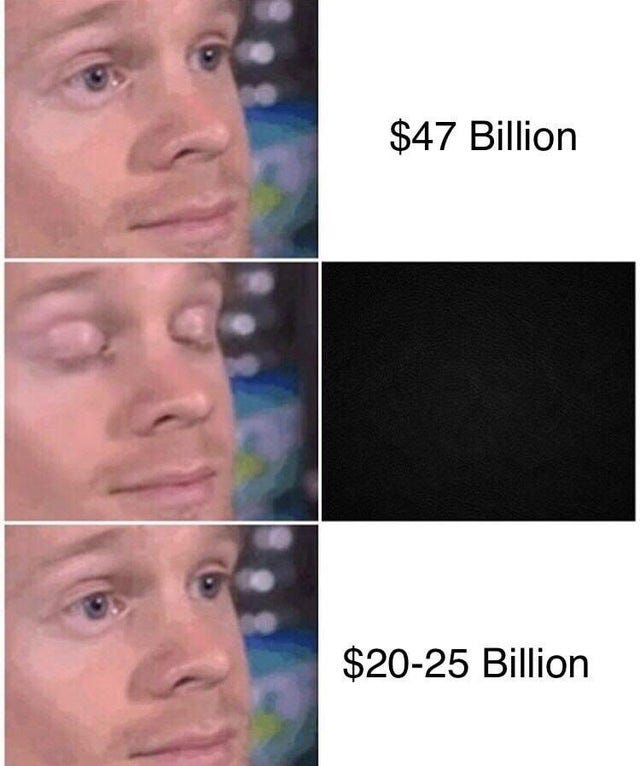

Should you buy levering up here ?

Source: fear & greed index

As industry experts, we emphasize these points to our clients on a daily basis. We hope this article has provided valuable insights and information that can help you address potential issues in your own crypto business.

If you require professional advice and guidance to maximize your long-term sustainability, do not hesitate to reach out to us !