How to Get a Loan in Minutes, at a Lower Cost, and with No Expiry

DeFi Lending, an Untapped Opportunity

Everyone in the market is hungry for credit.

Businesses need credit to buy new assets, make investments, pay employees, for working capital and many other use cases. Investors often need credit as leverage for new trades and investments, or to bridge liquidity gaps between transactions. Individuals rely on credit for home purchases, investments, starting businesses, and much more.

While there are numerous avenues to access credit, the most conventional and widely employed method is certainly BANKS. Their business model is the creation of money to then lend it out for productive purposes or to support speculative activities.

Banks serve as a crucial channel for accessing UNCOLLATERALIZED CREDIT, which forms the essential lifeblood of any thriving economy.

The Issues with Traditional Credit

While banks play a crucial role by offering credit, even without requiring collateral, their effectiveness on the job is decreasing rapidly.

In developed Western economies, obtaining loans through banks is getting tougher, especially for SMBs and individuals. Meanwhile, millions in developing economies still lack access to banks, excluding them from the global financial system and restricting their access to financing.

The banking system is also facing heavy regulations in the midst of the past 20 years of crises and debacles, which has forcibly made financial institutions more risk averse. It is now much preferable for them to lend only to large corporations or funds, neglecting the middle and lower markets.

The banking channel does therefore face several issues, with BEUROCRACY and RENTIERISM being the most impactful.

The average time to obtain a loan through a bank is very SLOW…. According to a survey by the Federal Reserve, small businesses reported an average processing time of about 26 days for a traditional bank loan.

It is also quite EXPENSIVE, as there are many associated processing fees with a loan, according to fees could rack up to 0.25% to 0.5% per year which doesn’t seem much on face value but could mean a lot over a longer time horizon.

In a move not seen since the 70’s, Interest rates have risen in 2022 and 2023 to up to 4.5% in Europe and even higher to the US - a far cry from negative interest rates in 2020 and 2021.

Source: Koyfin

This is going to have a large impact on economies all over the world, which have to face the higher interest rate cost on their existing loans as well as having to deal with the increased cost of borrowing in the future.

For all the reasons stated and also due to geopolitical tensions, traditional sources of capital are drying up and the cost of financing are rising.

Management teams, investors and retail should be looking at OTHER SOURCES of financing that are OUTSIDE of the banking system.

The standard way is tapping into the Shadow Banking system, where one can get loans from private credit funds, and other financial intermediaries.

Generally, these sources are much more expensive demanding higher interest rates for the additional risk. It is also a solution that’s not very much accessible to retail and SMBs, but just a prerogative of large corporations and institutions.

The MAIN PROBLEM of all of these alternatives is that they rely on intermediaries and what is by now an OUTDATED technological infrastructure and payment layer…

Settlement times are long, taking sometimes almost a week for funds to move, and also very expensive as there are many intermediaries that don’t really provide that much value but you nevertheless still have to pay.

There’s however a NEW SOURCE OF CREDIT that is basically untapped by most companies, funds and retails out there…

The Opportunity in DeFi Lending

With the advent of blockchain technology, an entire new financial system was developed over the past 12 years. Starting from the currency layer, this new system is building the different pieces of the stack needed to build a real financial market.

Thanks to prior innovations like smart contracts, pools and stablecoins the ushering of digital asset based lending was possible, with the cambrian explosion of decentralized money market protocols like AAVE and Compound.

These applications enable anyone to log on with a wallet, just as you would log into your bank account with a PIN and you get an IBAN. There’s no bank clerk, there’s no checks or KYC, and by posting some collateral in digital asset, you can receive a loan of up to 80% LTV in matter of minutes.

And the beauty of it, is that you don’t have to pay capital + interest every month and it doesn’t expire. You can literally pay the loan back in 50 years if you wanted to.

This digital infrastructure that has been built and battle tested over the past three years is available to any business, investor or retail …

But not even 1% of the population has ANY INDEA this alternative exists…

Some of you might not be familiar with how defi credit markets work under the hood, but it’s a complex topic that’s not too much relevant for this article today.

Let’s look at what makes DeFi great and what doesn’t:

Advantages of DeFi Lending:

Global Access: DeFi lending is open to anyone with an internet connection and a digital wallet, enabling global participation.

Speed: DeFi loans are processed quickly, often within seconds, thanks to smart contracts and blockchain technology.

Transparency: All transactions and lending terms are recorded on the blockchain, offering transparency and traceability.

Lower Costs: DeFi lending typically has lower fees and interest rates due to reduced overhead and competition.

Security: The decentralized nature of DeFi makes it resistant to centralized system failures and fraud, enhancing security.

No Intermediaries: DeFi eliminates the need for intermediaries like banks, reducing bureaucracy and potential bias.

Decentralization: Decentralized systems are less susceptible to government regulations and censorship, giving users more control.

Disadvantages of DeFi Lending:

Require Collateral: A certain amount of collateral is required to access the loans. There are still no mainstream cases of decentralized protocols that provide uncollateralized credit.

Hacking Risks: DeFi platforms can be targeted by hackers, and security breaches can result in significant losses.

Regulatory Uncertainty: DeFi operates in a regulatory gray area in many countries, potentially facing legal challenges.

Market Volatility: Cryptocurrency values can be highly volatile, affecting the value of collateral and the stability of loans.

Complexity: DeFi platforms can be complex and difficult for newcomers to navigate, leading to potential user errors.

While we know there are some downsides to using these tools, it's pretty clear that this new financial system can bring some undeniable opportunities for everyone, whether you're super savvy or just getting started in business.

Are you unfamiliar with digital assets or DeFi ?

We’ve been working with this asset class since 2015 but we’ve also operated in the traditional world of business too for almost two decades.

We can help you bridge your knowledge gap and start using this knew financial tools for your benefit.

BOOK A CALL with a member of our team

Clicking the button below

An Effective DeFi Strategy

Let’s look at a real, step by step example of a strategy that anyone can apply today using DeFi. It’s a trade we’ve personally put on in our own portfolios multiple times, so it’s not just theory.

Disclaimer: this is not investment advice and we’re not promoting any specific platform or investment scheme. The example is for educational purposes only.

Let’s say we have a business that has accumulated $1,500,000 in cash and we’re looking to diversify its cash holdings in securities, but also some digital assets:

We decide to allocate $500,000 of our treasury to Bitcoin.

We buy BTC on the Ethereum blockchain, as we want to use these digital assets as collateral to obtain a loan on the AAVE platform.

We post our BTC as collateral on AAVE through a wallet like Metamask.

This process will take at maximum a few minutes, and there’s no credit or KYC check as it’s all done on-chain.

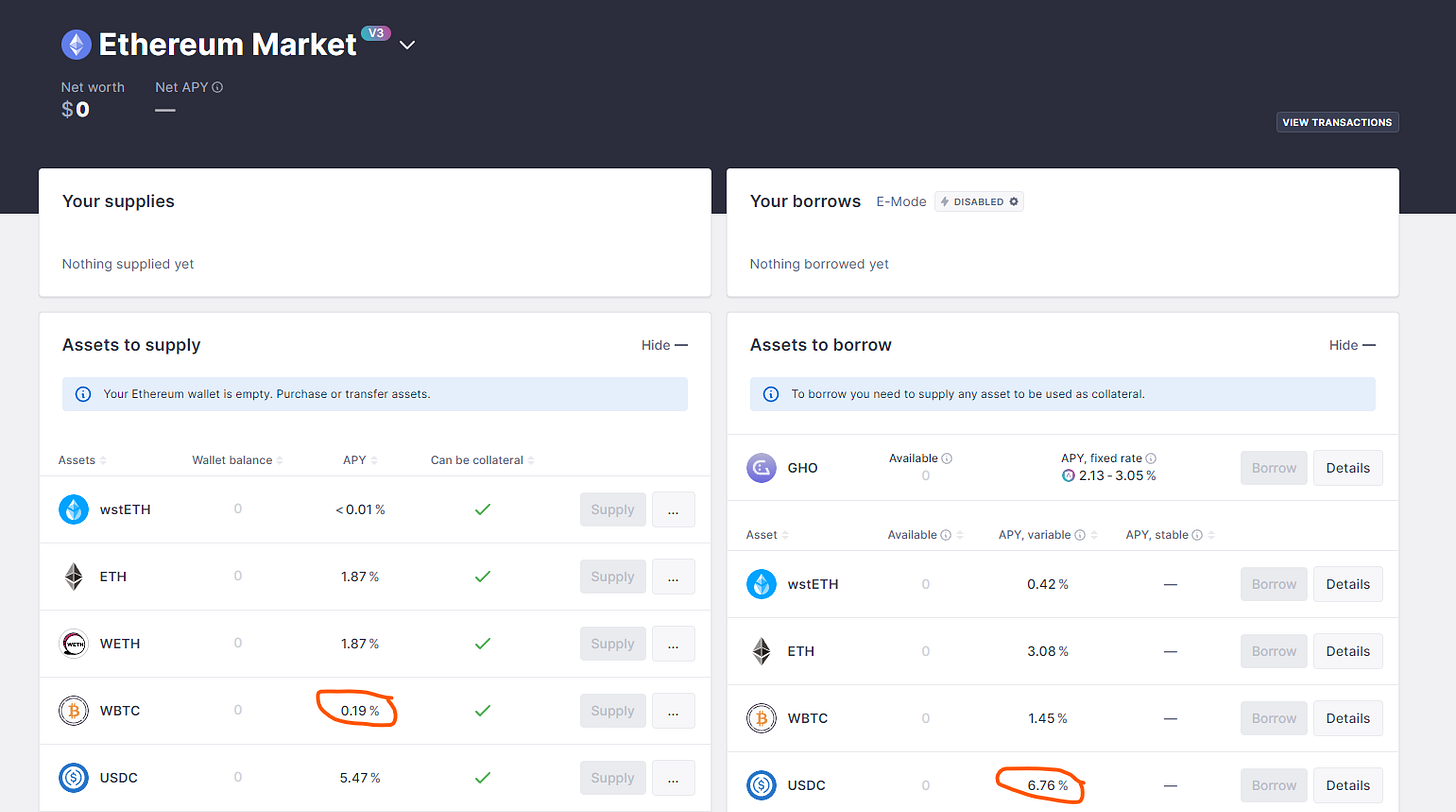

Below a quick snap at the interface on AAVE:

On the left hand side there’s the positive yield we’re going to earn on our collateral, $500,000 worth of BTC. In this case for BTC is just 0.20%, so it’s quite irrelevant for our example (we won’t count it in the numbers).

On the right hand side there’s the borrowing yield, or the yield we’ll have to pay on the capital we want to borrow, in this case it’s denominated in the stablecoin USDC, on which we’ll have to pay 6.76% APR.

The rates are variable or could be locked at a fixed rate depending on market conditions. For this example we’ll use this as fixed rate.

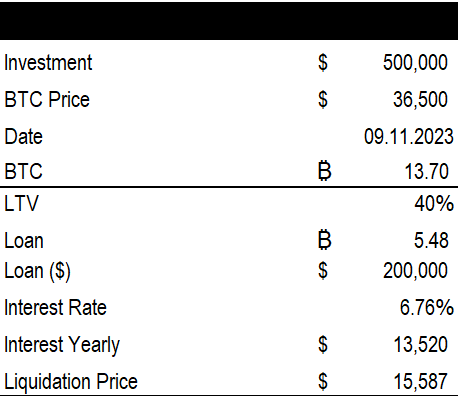

Let’s take a look at our assumptions:

With $500,000 we’ve bought around 14 BTC, which we’ll post as collateral on AAVE.

We’ll then take out a loan of 200,000 USDC, equivalent to around 40% of the value our collateral, or in other terms a 40% Loan to Value Ratio.

With AAVE, you don’t have to pay capital and interest every month, but you can repay whenever you wish as there’s no expiration date.

The thing to pay attention to is that our collateral doesn’t lose to much value, as there’s a Liquidation Price at which AAVE will liquidate our assets to compensate for the 200,000 credit we haven’t yet repaid. In this example the liquidation price is around $15,500 per BTC.

The idea behind this strategy is that we want our business to hold on to some digital assets, as we believe that they’ll appreciate in the long term. To take advantage of this trend, we can leverage our BTC holdings and take out a loan our business can use for other purposes.

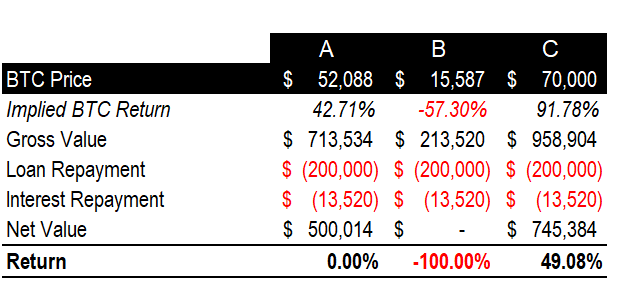

Let’s see what happens by simulating different price regimes of Bitcoin in the following table:

Legend:

Gross Value: value of BTC collateral

Loan Repayment: payment of the USDC loan

Interest Repayment: Interest accumulated over 12 months

Net Value: value of collateral net of repayments

Return: the percentage return of our strategy against our holdings of $500,000

Let’s analyze the different outcomes after 12 months:

Scenario (A): at around $52k, we’ve reached our break even point as we’ll have the possibility to pay back the loan of $200,000 plus interest, and still have around the same amount of collateral as when we started out.

Scenario (B): this is the worst case scenario, the price of BTC went crazy and dropped over 57%. We lost a part of my collateral, and we’re left with 200,000 USDC that we haven’t paid back.

Scenario (C): this is the best case scenario, as predicted the BTC price has increased to $70,000 enabling us to pay back the debt and still have more than $250,000 of profit.

Scenario A and B could be very beneficial as we could have repaid our loan at no cost (A) or made a profit on it as well (C).

On the other hand, the problematic one is scenario B, as we don’t want our business to have to incur a loss. The liquidation price is very low with an LTV of 40%, which could give us confidence given the ample margin of error considering BTC volatility.

Not everyone is a risk taker… for some even the remote probability of a 60% drop is something they can’t sleep at night with.

Sleep Better with an Hedged Strategy

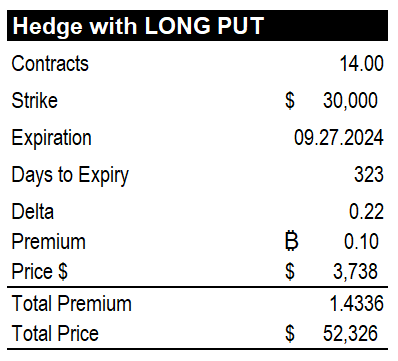

For those with a more prudent risk profile, an hedge could be employed to protect our BTC position. For this example, we’ll use a simple LONG PUT contract as an hedge.

Below you can see the main data on the option contract:

Legend:

Contracts: number of PUT contracts

Strike: price under which our options will go ITM

Expiration: date of expiry of the option contract

Delta: the variability of the option contract to changes in BTC price

Premium: the price of the option in BTC

Price: the price of the option in dollars

Total: total cost of our option contracts

We decide to buy 14 PUT option contracts, that are going to expire in September 2024 for a total of $52,326. We pick a contract with delta of 0.20, with a strike price of $30,000.

We decide to buy this contract to protect our BTC holdings, as our PUT options will limit our losses if the price of BTC goes against us.

On the other hand, if we were right and the price of BTC increases a lot over time, we’ll have our profits reduced as we’ll have spent around 10% of our capital to hedge our position.

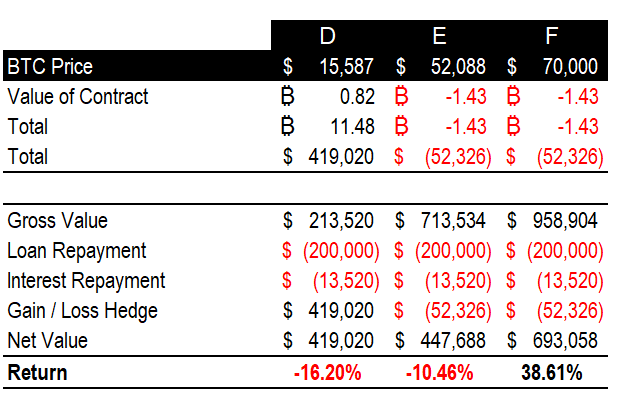

Let’s now see how our hedged strategy could perform under different scenarios in the following table:

Legend:

Value of Contract: value a single option contracts in BTC

Total: value our option contract entire position in BTC and dollars

Gain / Loss Hedge: the result of our PUT option position in % terms

Let’s analyze the different outcomes after 12 months:

Scenario (D): as we’ve seen before, this is the worst case scenario, the price of BTC dropped over 57%. Our put option contracts have soften the blow considerably, having in total lost only 16.2% of our initial dollar investment.

Scenario (E): at around $52k, our BTC holdings will have increased in value but our option contracts would have expired worthless, costing us around $52,000. In dollar terms, we’d be down around 10.5% if we would repay the debt at this point.

Scenario (F): this is the best case scenario, as predicted BTC price has increased to $70,000 enabling us to pay back the debt, and still have a profit of almost 39%, even though our options have expired worthless.

Which Strategy wins out ?

By comparing the performance of the Naked Strategy, and the Hedged Strategy we can see the pros and cons:

If we’re really bullish and can stomach the volatility, we can proceed with the Naked strategy, which will give us the opportunity to pay back our loan quicker (A) or obtain the most returns in the best case scenario (C).

If we’re more risk averse, the hedged strategy will provide us more cover, ensuring we don’t go bust in the worst case scenario (E) losing only 16% against a 57% loss in dollar terms. If BTC instead will rise to our best case price (F), we’ll have sacrificed around 12% in profit to cover our downside.

Actually the hedging strategy could be even more profitable over a long time horizon if we look at things in Bitcoin terms, but this is a complex topic and outside the scope of this article.

Tap into DeFi Lending Markets

From this simple strategy, we wanted to demonstrate how accessible and easy it is to tap into a completely new source of financing.

The DeFi ecosystem is just beginning its growth, offering a frictionless, faster, and cheaper alternative to traditional financing sources.

Our team has recognized this trend and is actively capitalizing on it. Similar to AI, we believe these financial technologies will be crucial in determining business success in the future.

Do you want to leverage crypto based loans for your business or portfolio ?

We won’t lie to you, using these tools is still quite difficult for non experts, so starting out on your own can be quite dauting.

We can fast track your knowledge of DeFi, help you improve your asset and liability exposure, reducing your costs and improving your returns.

Set-up a free intro consultation with us.

BOOK A CALL by clicking the button below