Deep Value Dispatch (8X potential)

When investors ignore a potential stock with returns from crypto companies

Anton Oilfield Services Group (3337 HK): The Forgotten Cigar-Butt of Hong Kong

You know us, we look for opportunities across different asset classes, but today we have a very promising company.

Some market stories never change.

In the 1950s, Benjamin Graham hunted for stocks trading below their net current asset value; decades later, Walter Schloss built a lifetime track record buying dozens of such “broken” companies at deep discounts.

In 2025, hidden in the quiet corners of the Hong Kong Stock Exchange, one of these cigar-butts still smolders: Anton Oilfield Services Group (HKEX: 3337).

🔩 The Business

Anton provides integrated technology services for the oil & gas industry — drilling, well completion, field management, inspection, and maintenance.

The company operates across China, the Middle East, Africa, Central Asia, and Latin America, with more than 30 field bases worldwide.

In FY2024, revenue reached RMB 4.75 billion (+7 % YoY), net profit came in at RMB 257 million, and free cash flow stood around RMB 1.14 billion.

During FY2025, Anton kept its steady momentum:

New orders (Q2 2025): RMB 3.01 billion (+14.2 % YoY)

Net profit (H1 2025): RMB 166 million

Final dividend (FY2024): RMB 0.025 per share

Buyback authorization: up to 10 % of shares outstanding (296 million shares)

At the same time, the company unveiled its “Strategic Guideline 2025”, aiming to evolve toward “green energy services” and AI-driven drilling solutions by 2030.

💰 Key Numbers (October 2025, Yahoo Finance & Reuters)

Share Price: HKD 1.13

Near the lower end of 52-week range (0.54–1.62)

Market Cap:HKD ≈ 3.0 b (~USD 380 m)- Overlooked small-mid cap

Price/Book0.85× - Clear discount to book value

Debt/Equity≈ 55–60 % - Moderate, manageable leverage

ROE (TTM)≈ 8.5 % - Respectable profitability

Dividend Yield≈ 2.5 % - Growing capital return

EV/FCF (2024)≈ 2.4× - Exceptionally low multiple

P/E 2025e≈ 8.3× - Compressed valuation

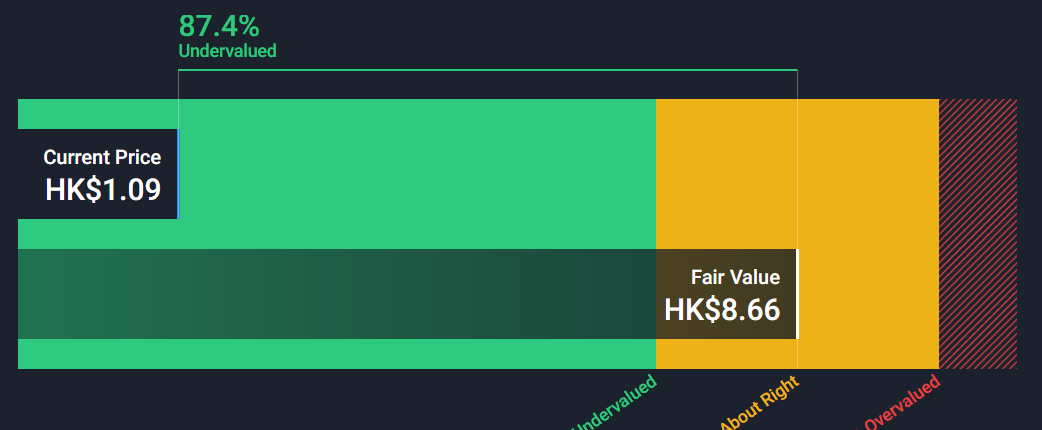

(Sources: Yahoo Finance, Reuters, SimplyWallSt – Oct 2025)

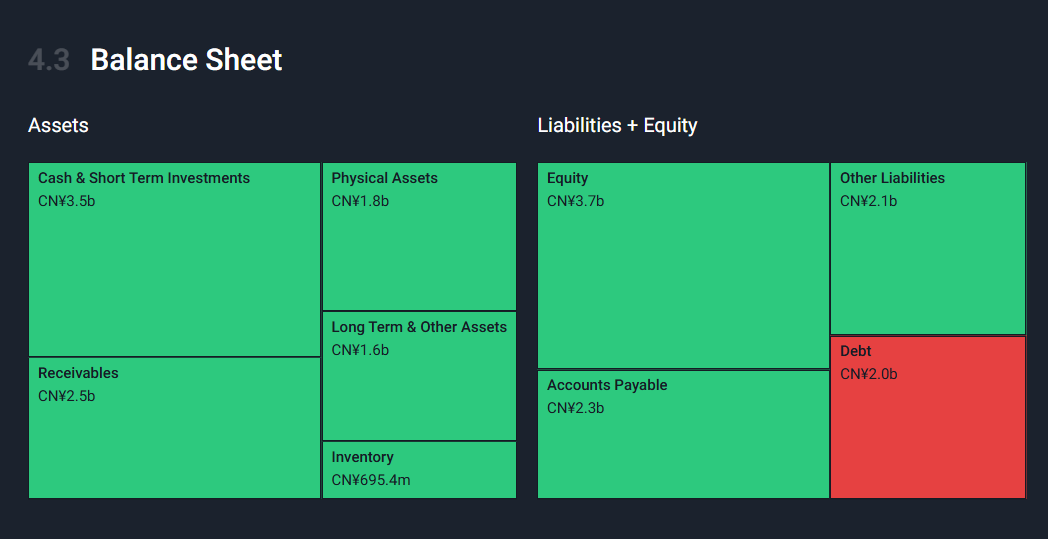

As of December 31 2024, Anton reported RMB 10.2 billion in total assets, more than 85 % of which are tangible:

Cash + Deposits: RMB 2.56 b

Accounts Receivable: RMB 2.33 b

Inventory: RMB 0.77 b

PPE: RMB 1.71 b

Intangibles + Goodwill: RMB 0.61 b

Total liabilities were RMB 6.6 billion, resulting in a Tangible Book Value ≈ RMB 3.0 billion.

With a market capitalization around RMB 2.7 billion, the stock trades at roughly 0.9× TBV — meaning the market effectively assigns zero value to the operating business.

As Buffett once summarized:

“If a business is worth a dollar and you can buy it for forty cents, something good may happen.”

In Anton’s case, investors are paying 85 cents for a dollar of tangible assets — and getting the cash flow thrown in for free.

⚠️ Key Risks

Oil & Gas Cycle – Revenue depends on E&P capex; a prolonged oil slump could hit order volumes.

Customer and Country Concentration – Exposure to large clients and higher-risk regions (Iraq, Africa).

Mortgages & Leases – About RMB 1.3 b in lease liabilities and RMB 2.0 b in secured loans limit flexibility.

Slow Re-rating – HK small caps can stay undervalued longer than investors stay patient.

🪙 Investment Thesis

Anton Oilfield is a deep-value industrial play with clear asymmetry:

Downside Protection: tangible assets ≈ market cap.

Upside Potential: normalized earnings and a rerating from 0.9× to 1.3–1.5× book (30–60 % upside).

Catalysts: ongoing buyback, recurring dividends, rising international orders, possible M&A.

This isn’t a bet on crude prices — it’s a bet on the market’s inefficiency in recognizing intrinsic value.

📈 Conclusion

At roughly HKD 1.13 per share, Anton Oilfield Services Group combines real cash flow, tangible assets, and market neglect — the classic ingredients of a Schloss-style cigar-butt.

It’s not glamorous, but as Schloss taught, quiet, boring businesses bought cheap often deliver the loudest compounding over time.

For deep-value investors who prefer numbers over narratives, Anton deserves a place on the 2025 watchlist.

Disclaimer – This article is for informational purposes only and does not constitute investment advice. Data are sourced from publicly available filings and Yahoo Finance; figures may contain estimates or reporting delays.