Disclaimer

This article is for informational purposes only and is not to be considered in any way financial, investment, or legal advice. The content reflects current views and is subject to change.

zkSync and related technologies are complex and involve risks. Readers should do their own research and seek professional advice before making any investment decisions.

The authors do not guarantee the accuracy or completeness of the information provided and are not liable for any reliance on it. Participation in blockchain and cryptocurrency involves risks, including market volatility and regulatory changes. This is not to be considered an offer to buy or sell any securities. Use this information at your own risk.

The facts

In this article, our founder Antonio (@algocapitaldao) will share an innovative trading idea that he has developed and now decided to share with his closest network of contacts.

First, let's conduct a macroeconomic context analysis. Currently, Bitcoin is showing greater resilience compared to altcoins. At this moment, altcoins are being sold by internal investors of the projects, while new buyers, both institutional and retail, are absent from the market. Bitcoin's dominance has increased, whereas investors have reduced their positions in altcoins in recent months.

Uncertain how to navigate these volatile and ranging markets?

Having traded and invested in TradFi markets since 2007 and in cryptocurrencies since 2015, Algo Capital DAO brings a unique blend of expertise to digital assets trading. Our insights and strategic guidance empower traders, investors, and entrepreneurs alike.

Schedule a free intro call with our team today by clicking the button below.

Why are we buying zksync?

The exponential growth of blockchain technology and the increasing adoption of decentralized applications (dApps) have highlighted the need for scalable and cost-efficient solutions on the Ethereum network. As Ethereum's popularity has surged, so too have its transaction fees and congestion issues, posing significant challenges for users and developers alike.

zkSync emerges as a groundbreaking protocol designed to address these challenges, leveraging zkRollup technology to provide a scalable, low-cost, and secure alternative to Ethereum's Layer 1 (L1) solutions.

zkSync operates as a trustless protocol, utilizing zero-knowledge proofs and on-chain data availability to ensure the security of users' funds, akin to the security provided by the Ethereum mainnet. This innovative approach allows zkSync to offer several key advantages over traditional Layer 1 solutions and other Layer 2 (L2) scaling techniques, such as optimistic rollups.

Key Advantages:

Among the primary benefits of zkSync are:

1. Low Gas Fees: zkSync significantly reduces gas costs, offering up to 1/100th of the gas fees compared to a Layer 1, and is more cost-effective than optimistic rollups.

2. High Throughput: With the capability to process over 2,000 transactions per second (tps), zkSync vastly outperforms Ethereum’s current rate of approximately 14 tps.

3. Enhanced Security: The protocol is secured by the main Ethereum blockchain, ensuring that user funds remain safe and secure.

4. Frictionless Transfers: zkSync enables seamless movement of assets between Layer 1 and Layer 2 without delays, enhancing user experience.

5. Censorship Resistance: Users maintain the ability to move their assets back to Layer 1 at any time, ensuring full control and resistance to censorship.

As observed, zkSync’s technology appears to outperform optimistic rollups and demonstrates greater speed compared to other projects utilizing zk rollups. Its integration with the established Ethereum blockchain, the second largest by market cap, positions the protocol to leverage over 8 years of Lindy Effect and Ethereum’s established reputation in the industry.

Let’s now take a look at zkSync funding history, with a particular focus on understanding the quality of the investor that decided to back the project.

Funding History

zkSync has successfully raised significant capital through multiple funding rounds since its inception. Here’s a closer look at their fundraising journey:

Initial Seed Round

The initial seed round occurred on September 23, 2019, when zkSync raised $2 million. Placeholder Ventures led this round, with participation from DragonFly Capital, 1kx, Hashed Fund, and Dekrypt Capital. This initial funding was pivotal in bringing zkSync from concept to reality, setting the stage for its subsequent success.

Seed Round

On October 1, 2021, zkSync completed a seed funding round, raising $6 million. This round included investments from Andreessen Horowitz (a16z), DragonFly Capital, 1kx, Union Square Ventures, and Placeholder Ventures. The funds from this round helped lay the groundwork for zkSync’s initial development and deployment.

Series A

The Series A round took place on November 8, 2021, raising $50 million. Leading this round was Andreessen Horowitz (a16z), with significant contributions from DragonFly Capital, ConsenSys, 1kx, OKX Ventures, Alchemy, and several other investors. This round played a crucial role in accelerating zkSync’s growth and expanding its technological capabilities.

Series B

Earlier, on January 27, 2022, zkSync secured another $200 million in a Series B funding round. This round was notably backed by BitDAO, further bolstering zkSync’s financial foundation and enabling continued development and scaling efforts.

Series C

On November 16, 2022, zkSync raised $200 million in a Series C funding round. This round saw participation from several prominent investors. DragonFly Capital and Blockchain Capital led the round, with additional investments from Andreessen Horowitz (a16z), Lightspeed Venture Partners, Variant, and one undisclosed investor.

This substantial funding, totaling over $458 million over three years, underscores the strong interest and confidence in zkSync’s potential to revolutionize Ethereum scalability. The high-quality investor base the project attracted further indicates a strong consensus on the venture's fundamentals.

Token Generation Event & Listing

The ZK token recently had its TGE and was listed on Tier 1 CEXs like Binance and HTX. This listing has provided ZK with the necessary liquidity to ensure positive prospects. As we've emphasized repeatedly, crypto markets revolve around liquidity. Securing a listing on a Tier 1 exchange is currently the only way to obtain sufficient liquidity to maximize the project's potential value.

As shown in the price action chart below, following the listing, there has been a slow sell-off, and the price has gradually declined from the ATH of $0.32 reached on the listing day. As of today, the price is around $0.155, less than half the ATH price.

This initial sell-off is typical of token launches, which usually involve unlocking a portion of the tokens for sale on the day of the TGE, allowing some participants to liquidate a portion of their holdings for the first time.

The launch must take place in the right market environment-timing is essential.

Unfortunately, many token launches have poorly designed release schedules and lack the experience in public markets to plan them properly. It is often a shame to see good projects with a solid business model, sometimes even with a billion-dollar market capitalization, get their maturation plans completely wrong and jeopardize their token. If you want to see a prime example, just look at the price performance of Arbitrum ($ARB) after the protocol unlocked more than 40 percent of the supply in one fell swoop in March.

In cryptocurrency markets, whether we like it or not, the token is the product.

Thinking about issuing tokens but unsure about the best capital market and token unlocks strategy ?

Algo Capital DAO’s business model has been designed to solve this. Instead of paying fees to consultants you can partner with us for the long term, and let us take care of your internal capital market strategy.

Through a token swap deal, you'll gain exposure to our native $ALGO token, while our DAO adds your token to our balance sheet. In addition to merging cap tables, we will secure our investment by offering tailored capital market and token economic design expertise to you as token holders.

This isn't about a principal-agent setup or entrusting your treasury to a third party. Algo Capital DAO becomes your in-house capital markets team. Focus on your business while we handle all the details of your token strategy.

Schedule a free intro call with our team below

Vesting Schedule

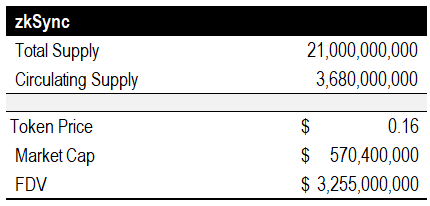

The table below showcases some general data on the token supply and market cap of ZK today.

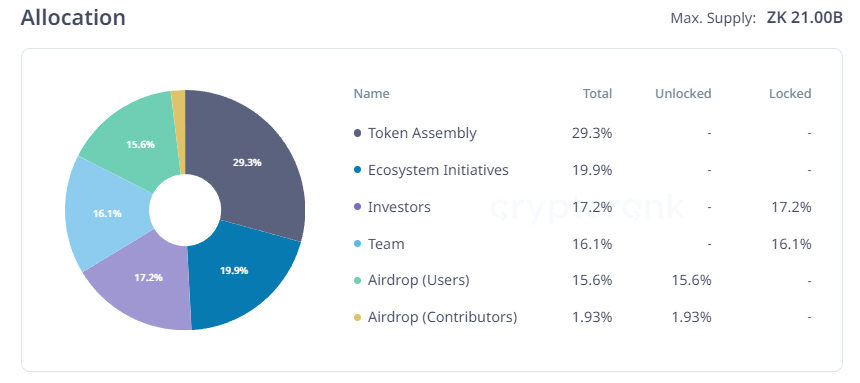

We can notice that around 17.5% of the total supply has been unlocked at TGE as it’s also visible from the graph below:

Here it’s interesting to note that the tokens unlocked during TGE where held by Airdrop users and contributors. They will be the main sellers during the initial months following TGE.

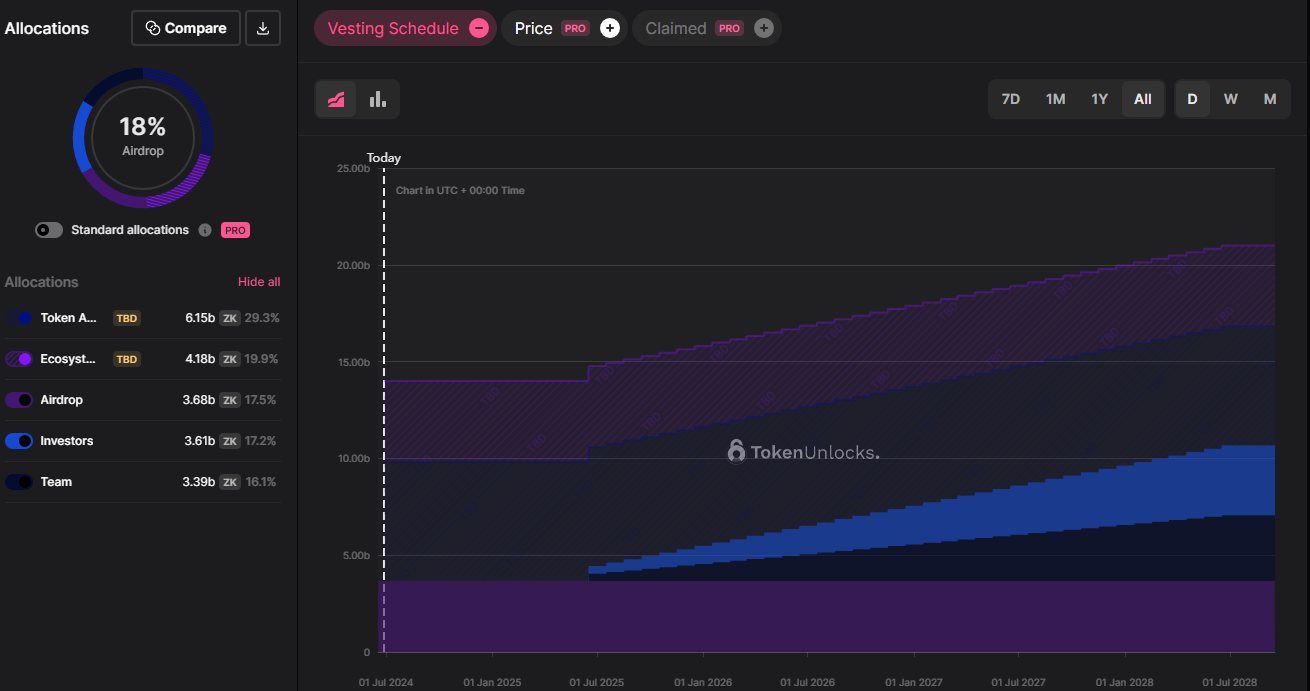

Below we can observe instead the vesting schedule from a graphic perspective:

From the graph, it's evident that there won't be significant unlocks of new supply into the market following the TGE until 12 months later. This data point is crucial as it signals when the price might face downward pressure from new selling.

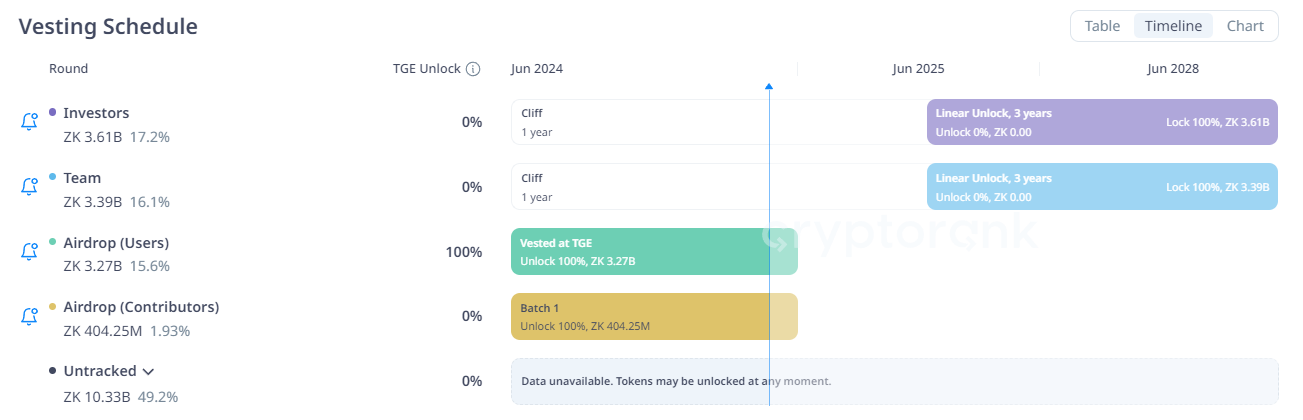

The figure below represents the same data, but gives further information to analyze:

Both the team and investors face a one-year cliff, meaning token sales are restricted until June 2025. Investors hold approximately 17% of the supply, with the team holding around 16%, totaling 33% of the total supply.

Airdrop participants have already unlocked their entire holdings, accounting for about 17.5% of the total supply. The remaining tokens are allocated to Token Assembly and Ecosystem Incentives, comprising about 49% of the supply.

Our target date is June 17th, 2025, when over 3.67% of the total supply will be unlocked, providing the first opportunity for investors and the team to monetize their holdings. Subsequently, there will be linear monthly unlocks of approximately 0.82% over three years.

Investment Strategy

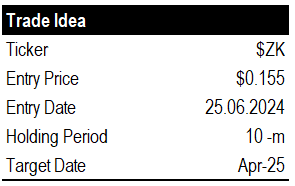

Our investment strategy is based on the timing of the first token unlock, which is scheduled to occur in approximately one year, on June 17th 2025.

We believe the team, investors and market makers will actively work to support the token price leading up to this event. Therefore, our plan is to purchase $ZK tokens now and hold them for at least 10 months.

We then intend to sell our position about two months before the unlock date.

From our observations above, the tokens in circulation at the TGE were primarily sold by individuals who obtained their tokens through Airdrops. This has influenced our decision to invest early, capitalizing on the anticipated price support by the team and the controlled token release schedule.

The current market environment is also in our favor, allowing us to time this investment during a period of short-term bearishness and compressed volatility. This gives us a better entry price and more potential upside in the future.

Below a summary of our trade idea:

As we near our target selling date, we will reassess the performance of our trade and promptly update you on any adjustments we make to our position.

If you are interested in our investment ideas and want help implementing them correctly, you can contact us.